A forward exchange contract is a way to exchange currencies at a fixed price on a future date. With it, you can set the exact cost of your money transfer in advance, so you don’t have to worry about rate changes. This guide will explain everything you need to know.

Jonathan Merry Artiom Pucinskij July 10th, 2024 Disclosure On this page Forward contracts explained Risks and benefits of using forward exchange contracts When it matters. for you? How do forward exchange contracts work? Taking out a forward exchange contract A bit more on forward contracts Recapping on forward exchange contracts Sources & Further ReadingA forward contract is an agreement to make a trade (such as converting currencies) at a future date with the cost of that transaction being agreed beforehand.

Forward contracts are made between two parties without the need for another organization (such as an exchange or clearing house) to act as an intermediary. The absence of an intermediary makes a forward contract an over-the-counter (OTC) instrument, which is customizable so that both parties agreeing with the trade are happy with the terms. Most commonly used for trading commodities, forward contracts are also a popular mechanism with which to exchange currencies.

A forward exchange contract is the term used to describe a forward contract specifically for a currency exchange, so there’s no real difference between the two.

A forward exchange contract is a forward contract by which an individual or business commits to buying a specific amount of foreign currency at an agreed date in the future, with the exchange rate applied to the transaction agreed in advance.

The rate of the exchange is set at the time that the contract is entered into, and the currency pair being traded constitutes the contract’s underlying asset.

In the case of money transfers, a forward exchange contract has four components:

Asset type: The currency that is specified to be purchased, for example, GBP/USD. Asset quantity: The amount of that currency. Settlement date: The pre-specified date of purchase. Price: The pre-specified exchange rate applied to the currency pairing.A forward exchange contract eliminates uncertainty by locking in the price of exchange in advance.

While eliminating the risk of loss should the exchange rate move in an unfavorable direction, this protection also eliminates the possibility of gain should it move the other way.

Here is a breakdown of the pros and cons of trading using forward contracts:

There are a variety of situations in which forward contracts can be helpful, as it can be useful to know exactly how much something will cost in advance - particularly when working on a tight budget.

Here are some situations in which you might want to consider a forward contract:

When buying something expensive, such as a holiday home, a forward contract can help you ensure that you can afford the cost even if the exchange rate moves in the future.

If you need to send a large amount of money to a friend abroad, either to help them with bills or as a gift, then a forward contract can help you ensure exactly how much they will receive.

If you have bills to pay in a country that uses another currency, you can use forward contracts to set the dates to pay these on time and be sure of the exact amount they will cost.

If you own a business that operates in multiple countries, then you might want to consider using forward contracts to ensure payments of any relevant business expenses such as salaries or commercial property rent.

It's becoming increasingly popular to plan life events abroad. For example, a destination wedding market is expected to reach 103.5 billion US dollars by 2033

. Planning ahead and getting all the large expenses (such as the venue, accommodation, travel, and more) locked in for your event can save you a lot in the exchange rates.

You can use forward contracts to generate financial gains if you read the currency markets correctly. For example, if you believe the pound is about to fall in value against the dollar, you can make a forward contract now to buy £100 worth of dollars at the current rate. If you’re right and the market moves against the pound, your dollars will be worth more than your original £100.

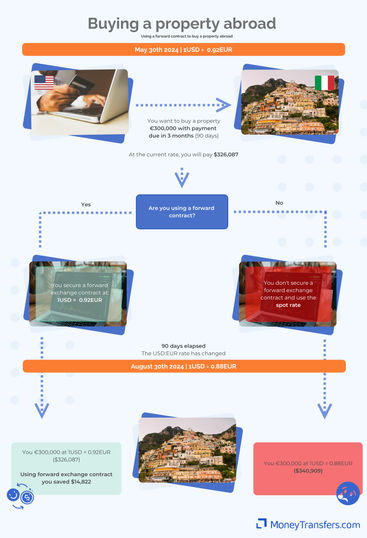

Taking a look at a forward exchange contract, we can see how forward contracts can be used to fix the price and settlement date of a currency exchange in advance.

This example will guide you through how it works.

Practical example: Buying a home in Italy from the USSuppose you intend to purchase property abroad. You have chosen a town in Italy, and your agent in the region tells you that it can take up to eight weeks to complete a transaction.

At the current exchange rate, your budget is just enough to cover the average price of a property in your chosen area.

You believe, however, that over the coming months, ongoing economic events will cause the Euro to strengthen against the US Dollar.

If this were to happen, your budget would effectively decrease before you’ve had the opportunity to complete a purchase and you might be priced out of buying the property.

To protect your budget, you can take out a forward contract and lock in the current rate of exchange for the USD to Euro pairing.

This ensures that the money you have available is not at risk of decreasing over time due to changes in the rate while you search for a property that you wish to buy.

There is the possibility that the exchange rate could move in the opposite direction after you have agreed to your forward contract.

If this were to happen, you’d still be locked into paying the exchange rate you previously agreed and you would end up spending more money than you would have needed to.

A forward contract will always run this risk, but it allows you to be certain that you can make your purchase regardless of market movements.

In recent years, money transfer brokers have sprung up on the internet and are now able to offer all the services that previously could only be accessed with banking institutions - including forward exchange contracts.

Banks still offer the ability to take out forward exchange contracts, but are often more expensive, take longer, and have more T&Cs to get it working.

Here's a quick comparison of making a transfer via a money transfer provider vs a bank:

Money Transfer Company

Amount Sent

Exchange Rate

Fees

Amount Received

€924.50

€905.20 (€23 less)

Whether or not a currency exchange is possible depends on the sending and disbursing network of the money transfer company.

A forward exchange contract is possible if a money transfer company supports the currency pairing for that exchange.

With the variety of money transfer providers around, you can usually find forward contracts offered for any currency pairing, but you might have to spend some time searching if you’re exchanging between two lesser-used currencies.

No, but it can be used for many common pairings. Usually, a forward exchange contract is possible if a money transfer company supports the currency pairing for that exchange.

With the variety of money transfer providers around, you can usually find forward contracts offered for any currency pairing, but you might have to spend some time searching if you’re exchanging between two lesser-used currencies.

Money Transfer companies allow a transaction to be canceled if it has not yet been completed.

While most companies (such as Paysend) require you to contact a customer support team by phone or email to request cancellation, others (such as Currency Fair) allow you to do so within your account with them.

Forward contracts are usually quite straightforward to cancel before the date for which the transfer is set, but doing so is likely to incur some fees.

When entering into a forward contract, the parties agree on a price for an exchange that will be unaffected by market movements.

As we have mentioned, you can use forward contracts to profit off speculating about market movements, but they can also be used for a process known as hedging - which is what was happening in the example further up this page about the house purchase.

When hedging, a person or business aims to mitigate the risk of loss by locking in the price for future trades.

This allows them to plan ahead, free of the uncertainty of market fluctuations in the price of the asset that they intend to buy or sell.

Take another look at the home purchasing example given earlier.

In this instance, in order to manage the risk of having less money to spend on a property, the house-buyer committed to purchasing Euros at a future date for the current rate of exchange.

By locking in a rate in advance of a transaction, the prospective house-buyer mitigated the risk of loss by hedging against any changes in the market value of the assets they were purchasing.

A futures contract is similar to a forward contract in that it is also an agreement between two parties to exchange an asset for a specific price at a future date.

Unlike a forward contract, however, it is standardized and terms cannot be changed to suit any particular position that two counterparties might wish to take.

Here are the key differences between a Futures Contract and a Forward Contract:

A futures contract is settled over a range of dates, meaning it can be bought or sold at any time

A forward contract has one settlement date, at which time the contract ends

A futures contract is standardized, its terms cannot be customized by the parties involved

A forward contract can be customized

A futures contract is traded through an intermediary, such as an exchange or clearing house

A forward contract is an over-the-counter instrument, with no third party needed

A futures contract has a lower risk of default due to tightened regulations

Since a forward contract is an OTC instrument, there's less oversight and a higher chance of default

A forward exchange contract allows you to lock the cost of your transfer for a given currency at a given date.

It's useful when you know the date you'll need to make a large transfer and believe the exchange market will move in your favor.

If you’re looking to arrange a forward exchange contract, then your best option is to compare the various money transfer companies that can provide them.

Simply use the form below, and we’ll show you your best options in a matter of seconds.